$150 Oil in 2025: Winners and Losers of an Iran-US War

Introduction

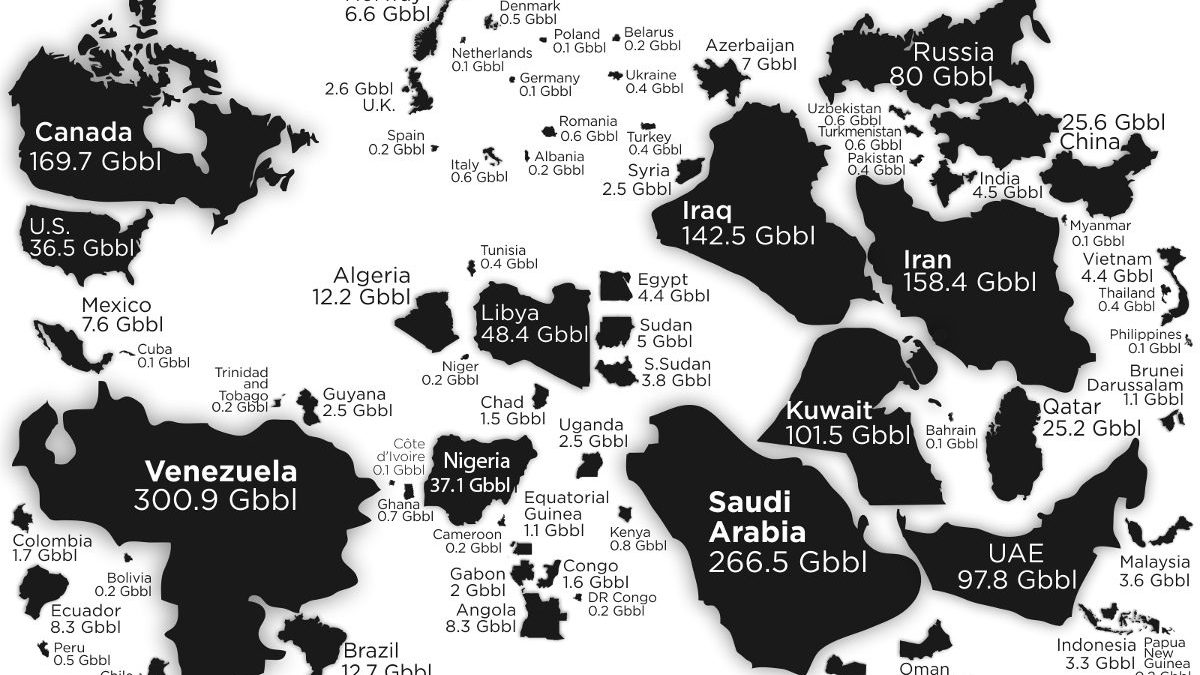

As 2025 unfolds, the United States, true to its history of sparking global conflicts, is once again rattling sabers against Iran—a nation that has never attacked another unless provoked first. Recent threats, echoing Trump’s past letters to Iran hinting at negotiation or war, feel like bluster to pressure Gulf allies. But what if this escalates into action? A war in the Persian Gulf—whose very name carries a history of contention—could spike oil to $150 per barrel, sending economic shockwaves worldwide. China, India, and Europe would reel first, while Iran might surprisingly hold its ground.

Oil Imports and Exports of Key Countries (Approximate, 2023-2025 Data)

| Country | Oil Imports (Million Barrels/Day) | Oil Exports (Million Barrels/Day) | Notes |

|---|---|---|---|

| United States | ~7-8 | ~3-4 | Net exporter; domestic production reduces import reliance |

| China | ~11-12 | ~0.2-0.5 | Largest oil importer; reliant on Middle East, including Iran |

| India | ~4.5-5 | ~0.1-0.3 | Growing importer; sensitive to price spikes |

| European Union | ~9-10 | ~0.5-1 | Vulnerable to Middle East disruptions |

| Iran | Negligible | ~1.2-1.7 | Exports limited by sanctions; mainly to China |

| Saudi Arabia | Negligible | ~6-7 | Major exporter; key U.S. ally in OPEC |

| UAE | ~0.5-1 | ~2.5-3 | Significant exporter; economy tied to oil and tourism |

| Russia | ~0.2-0.5 | ~4.5-5 | Major exporter; resilient to sanctions but impacted by price volatility |

The Oil Price Shock: $150 Per Barrel and Beyond

A U.S.-Iran conflict would almost certainly disrupt the Persian Gulf, through which roughly 20% of the world’s oil flows daily. Iran has long threatened to close the Strait of Hormuz in retaliation to aggression—a move that, even if temporary, would choke global supply lines. With Brent crude already sensitive to Middle East tensions (hovering around $80-$90 in early 2025), a sudden escalation could easily catapult prices to $150 per barrel, a level unseen since the 2008 peak, adjusted for inflation.

Immediate Losers: China, India, and Europe

The first to feel the sting would be the world’s largest oil importers: China, India, and the European Union. China, importing over 11 million barrels per day, relies heavily on Middle Eastern oil, including from Iran, which supplies 1.2-1.3 million barrels daily despite U.S. sanctions. A war would disrupt these flows, forcing Beijing to scramble for costlier alternatives—think Russian or African crude—at a premium. The result? Soaring energy costs would hammer China’s manufacturing sector, already strained by U.S. trade tariffs, slowing its economic growth from a projected 5% to perhaps 3-4% in 2025.

India, importing nearly 5 million barrels daily, faces a similar fate. With Iran historically a key supplier (though curtailed by sanctions), a conflict would spike India’s oil import bill, fuel inflation, and derail its post-pandemic recovery. The rupee, already fragile, could depreciate further, making imports even pricier and squeezing households and industries alike.

Europe, importing around 9-10 million barrels per day, would see its fragile energy security crumble. Dependent on diverse sources, including Middle Eastern oil, the EU would face shortages and price surges, exacerbating an existing energy crisis worsened by reduced Russian gas supplies since 2022. Inflation would climb, industrial output would falter, and recession risks—already looming in Germany and Italy—would deepen.

The U.S.: Short-Term Gain, Long-Term Pain

Initially, the U.S. might seem insulated. As a net oil exporter with robust domestic production (12-13 million barrels per day), it could capitalize on high global prices, boosting profits for shale producers and exporters sending 3-4 million barrels abroad daily. The dollar, a safe-haven currency, might strengthen as investors flee riskier markets, giving America a temporary economic edge over its rivals.

But this advantage would be fleeting. Higher oil prices would still filter into U.S. gasoline costs—potentially hitting $5-$6 per gallon—angering consumers and reigniting inflation, which the Federal Reserve has struggled to tame since 2021. American manufacturers, reliant on global supply chains disrupted by the crisis, would face higher input costs, eroding competitiveness. And if allies like Saudi Arabia ramp up production to offset losses (as they might under U.S. pressure), OPEC cohesion could fracture, leading to a longer-term price war that undercuts U.S. shale viability.

Global Economic Fallout

At $150 per barrel, the global economy—already projected to grow at a modest 2.8% in 2025 (per UN estimates)—could stall. Developing nations, unable to absorb the energy shock, might default on debts, triggering financial contagion. China, India, and Europe, as U.S. economic rivals, would suffer first, but America’s interconnected markets would not escape unscathed. A conflict born of bravado could thus become a self-inflicted wound, proving that even the world’s superpower cannot defy the laws of global economics indefinitely.

Why Iran Might Lose Less

Amid the chaos of a U.S.-led war, Iran’s resilience could outshine its oil-rich neighbors. Here’s why:

- Sanctions-Hardened Economy: Decades of U.S. sanctions have forged Iran’s “resistance economy,” less reliant on global trade than Gulf states. Unlike Saudi Arabia or the UAE, Iran thrives in isolation.

- Oil Already Curtailed: With exports at 1.2-1.7 million barrels/day—mostly to China—Iran’s oil is already sanctioned. A regional disruption would hit Saudi Arabia (6-7 million barrels/day) and the UAE (2.5-3 million) harder.

- Regional Leverage: Iran’s proxies could target Gulf oil facilities, crippling rivals while its inward-focused economy endures.

- Tourism Immunity: The UAE and Saudi Arabia’s tourism bets—like Dubai or NEOM—would collapse in war. Iran, with little tourism, sidesteps this loss.

- Strategic Gains: A weakened Gulf could elevate Iran’s regional role, especially if U.S. credibility falters in this colonial-tinged Middle East chessboard.

The Big Losers: China, India, Europe—and Eventually, the U.S.

At $150 oil, China’s factories (11-12 million barrels/day imported), India’s consumers (4.5-5 million), and Europe’s industries (9-10 million) would buckle. The U.S., despite its oil output, would face soaring gas prices and inflation, undermining early gains.

Conclusion

If America strikes, Iran’s resilience might make it a dark-horse winner in 2025, while its rivals—and the U.S.—pay dearly. The Persian Gulf’s next chapter could redefine global power, one barrel at a time.